Global Services Forecast (GSF) | 2024-2043

ENVISION FUTURE DEMAND TO CONNECT TODAY AND TOMORROW

Services accompany an aircraft throughout its entire lifecycle, from preparation of the entry-into-service, up to dismantling and recycling of an aircraft.

The Global Services Forecast (GSF) looks at the evolution of this highly competitive market, providing a forward-looking view of commercial aviation demand for asset maintenance, personnel training, flight and ground operations, as well as passenger experience. The 20-year forecast covers passenger aircraft counting 100 seats or more and freighters over 10 tons payload.

Today

Commercial aviation is constantly adapting, particularly with tight supply and rising demand in a worldwide context that is continuously evolving.

Demand for air travel has never been higher, 5 billion people are expected to fly in 2024. The world fleet utilisation is on the rise. Flight cycles are exceeding 2023 levels in all regions.

The trend is similar for Commercial Services demand. Services players are strongly working to safely and responsibly address and enable this surge in traffic demand.

Key figures

Tomorrow

Traffic growth, fleet evolution, aircraft replacement, digitalisation enabled by connectivity, and efficiency, will drive services demand over the next 20 years.

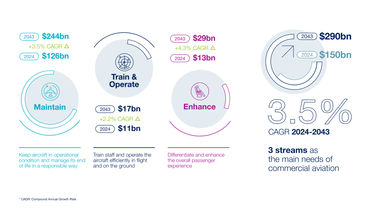

The commercial Services market is expected to reach $290 billion by 2043, for the ‘Maintain’, ‘Train & Operate’ and ‘Enhance’ streams, with 3.5% compound annual growth rate.

The regional fastest growth for services is expected in South Asia, China and the Middle East.

Over the next 20 years, we forecast a demand for more than 42,000 new aircraft deliveries. 18,460 of those are to replace older aircraft. More dismantling and overhaul capabilities are expected around the globe, to reuse, repair and recycle aircraft components.

The fast pace of digitalisation, enabled by connectivity, is one of the greatest leaps in the aviation industry. Tomorrow, connecting the dots between collaborative communities will be the cornerstone to break silos and improve the overall efficiency. It will be key to optimise flight operations, technical operations, and ground operations. A widespread access to integrated digital and harmonised connectivity solutions will enable a flexible user-centric approach, with a personalised use of data. In addition, enhanced connectivity will allow a seamless passenger experience, at any time.

This connected ecosystem will attract an increasing number of people with digital competencies. The upskilling required by the digital environment will increase job attractivity, hence helping to mitigate future workforce shortage and enhance operational efficiency.

Commercial aircraft services market will reach $290bn in 2043

Download documents

2024-2043

Airbus GSF 2024 - 2043 I Press Briefing 18 September 2024

GSF 2024-2043 - Highlights

GSF 2024-2043 - Photos

Infographics GSF 2024 - 2043

- 2024-2043